Dear Friends, ‘There are decades where nothing happens; and there are weeks where decades happen”Lenin“Investing for Good” or ESG investment is a theme which we covered in our webinars this month. We hosted the legendary Mark Mobius, who now manages a ESG focused emerging markets fund and his colleague Usman Ali, who is a Partner at Mobius… Continue reading Pakistan Macro Blog: Investing for Good in Pakistan: embracing ESG

Author: Anum Qudsia Siddiqui

KASB Securities tips for active trading

Despite the continued slump in the Pakistani stock market since the summer of 2017, which has seen the KSE-100 index drop from a peak index value of almost 53,000 points to around 34,000 points (at the time of this article being written), the market continues to exhibit ample money-making potential, especially for active trading. Investing… Continue reading KASB Securities tips for active trading

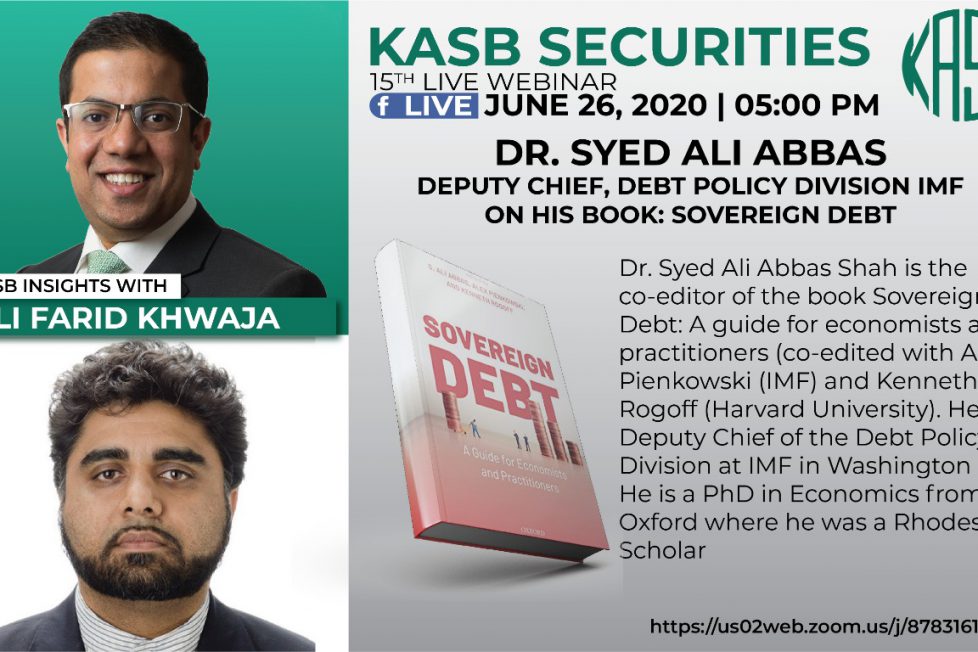

Key Takeaways from Dr. Ali Abbas’s Sovereign Debt Webinar (IMF)

The book was envisaged 10 years ago – the thought, the authors, and the publishers needed to be brought together before the ultimate fruition, which is a testament for academics to envision their end-goals well in advance. The book is written with the intent of communicating the distilled wisdom pertaining to sovereign debt issues to… Continue reading Key Takeaways from Dr. Ali Abbas’s Sovereign Debt Webinar (IMF)

The Trapped Saviour: Cement Sector of Pakistan

In a Nutshell Pakistan is one of the most populous country in world with population figure over 200 million. Just as with other instances of over population, the concept of scarcity is applicable here as well, especially with regarding to housing. Currently, the housing shortage in the country is estimated around 10.4m out of which… Continue reading The Trapped Saviour: Cement Sector of Pakistan

Dr. Syed Ali Abbas, Deputy Chief, Debt Policy Division, IMF, DC on his book Sovereign Debt

Daily news: 26th-June-2020

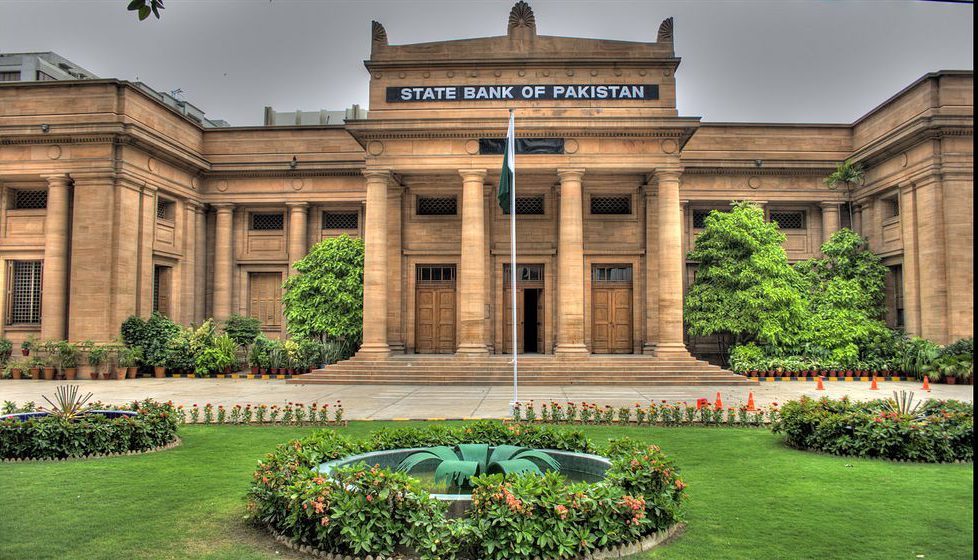

Good Morning The Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP), in its emergent meeting held on Thursday, decided to further cut the key policy rate by 100 basis points (bps) to 7 percent aimed to address the domestic economic slowdown due to the Covid-19 pandemic. The net foreign exchange reserves held… Continue reading Daily news: 26th-June-2020

MPS: Monetary Policy Committee cuts interest rate by another 100bps

In its meeting held today, the Monetary Policy Committee (MPC) cut interest rates by an additional 100bps to 7.0%, taking the cumulative reduction to 625bps since the pastthree months. The expedited pace of monetary easing has overshot our original estimates whereby we projected a 50 to 75 bps cut by year end 2020. In light… Continue reading MPS: Monetary Policy Committee cuts interest rate by another 100bps

SBP Reza Baqir “Does More” – Discount Rate cut by 100 bps to 7%

This was on the cards – as posted earlier today – after $1bn FX poured in, Current Account showed surplus & Inflation outlook ranged ~6% for next three years. The growth plunge warranted it amid benign inflationary outlook. Yesterday, the yield curve steepened after PIB auction. The space on shorter side is fixed today with… Continue reading SBP Reza Baqir “Does More” – Discount Rate cut by 100 bps to 7%

Pakistan Bond Auction yields up 30-39 bps : Good-bye further rate cuts?

In the recent bond auction, the yield curve has further steepened. Latest numbers reflect 7.97% (+33bps), 8.44% (+39bps), 8.99% (+30bps) and 9.90% (-7bps) for 3, 5, 10 & 15 years, respectively. Against the target of Rs 150bn, the govt accepted Rs 117bn. Clearly, the participants are realising that lowest yields are behind us. Perhaps, yes.… Continue reading Pakistan Bond Auction yields up 30-39 bps : Good-bye further rate cuts?

Pakistan’s tax payers bear Rs 692bn (~$5bn) loss -government inefficient entities

Wo Afsana Jisay Anjam Par Lana Na Ho Mumkin..Ussay Ik Khoobsoorat Mor De Kar Chor na Acha.. (those matters that can not be concluded should be left on an amicable note) Applies aptly to the saga of loss making PIA, Steel Mill, Railways, SSGC/SNGP and Power companies. Taxpayers lose Rs 2bn everyday. Imagine what we… Continue reading Pakistan’s tax payers bear Rs 692bn (~$5bn) loss -government inefficient entities