Dear Friends,

I got back to Karachi on Saturday. Over the last weekend, my colleague Faisal Irfan and I tracked the balance sheets of the top 30 companies which are a part of the KSE30 Index. In a typical growth market with high ROEs, an optimal balance sheet should have high leverage. However, we were surprised to see that the sample (excluding the banks) has a total of net cash of PkR42bn ($271m). This is concerning as it indicates that the companies are under-investing in their business expansion and hoarding cash.

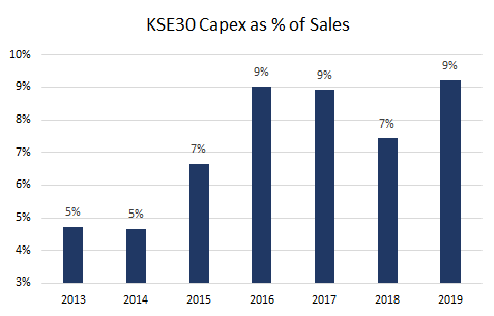

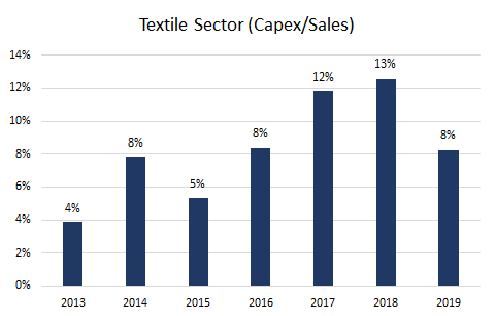

The total Capex level of the sample of the top 25 companies which we studied, has been stable at around 9% of revenues over the last four years. This is despite the capacity expansion cycles in sectors such as cement and power. We further looked into a sample of the top 5 textile companies which are a part of the KSE100 index. Within this sample, Capex has declined over the past three years (see chart below). This is a worrying sign. Given the fact that the Capex cycles in cement, power, and autos will subside next year, the data shows that there could be a sharp fall in business investment in FY2020.

It will be impossible for the government to reach its targets to increase exports if industrial sectors such as textiles are not increasing capacity.

As I wrote in my last blog, IMF’s stabilization policies are effective for surviving a balance of payment crisis. However, they tend to have little relevance for driving mid to long term economic growth. Of course, there are not too many, indeed if any, examples of economies that have done well following the economic policies of the IMF. Most serial borrowers from the multi-lateral agencies, such as Argentina, Egypt, etc are still basket-case economies with severe boom and bust cycles.

I find it very alarming that according to a recent research study published by the Asian Development Bank (ADB), Pakistan’s economy is “balance of payments constrained”. According to the study, Pakistan’s economy will face a balance of payments crisis again if its GDP growth exceeds 3.8% (click here). This means that 5-6% outer year growth rates which the Street is modeling are not feasible without assuming another bust cycle proceeding this.

From the market perspective, this means that while there could be a case for cyclical recovery and mean reversion trades, there will be little justification for a fundamental re-rating. Investors will come in when things stabilize and exit when the economic fundamental reach normal levels. This is not a very desirable outcome.

A 3.8% growth rate is also kind-of “dangerous” for Pakistan from a geopolitical perspective. India is expected to grow by 5.8% and Bangladesh’s economy is estimated to grow by 8.1% in 2019. If India and Bangladesh continue to grow over the next ten years at their average growth rate of the past 5 years, then by 2029 India’s GDP per capita will be 42% higher than Pakistan’s and Bangladesh will be 58% higher. The gap becomes even wider with time.

My friend, Dr. Salman Ahmad, who is the Chief Strategist of Lombard Odier, gives a striking warning when he says that the economic disparity between India and Pakistan might start resembling South Korea and North Korea unless Pakistan breaks this boom and bust cycle. (Personally, I am not a big fan of linear extrapolation and North Korea’s GDP per capita is 16x larger than South Korea – but I appreciate the underlying point he is making). If the economic outcomes between Pakistan and its neighbors become too different, it could lead to serious political implications domestically. Luckily for Pakistan, the Indian government seems to have shifted its focus from promoting the economy to promoting the radical religious agenda of Hindutva.

The solution is simple – it requires a sustainable effort to promote long term business investment. Short term foreign inflows through the debt market might stabilize the economy, but they cannot drive economic growth. That requires investment in the domestic industry.

Earlier this year, we published a report titled “Who Owns Pakistan” in which we tracked 17 family groups who control companies which account for 47% of the market capitalization of Pakistan. Some of these family groups are holding massive cash balances or they have strong balance sheets that should be levered to drive future growth. For example, Engro Corp controlled by the Dawood family has net cash of PkR60bn. An ideal level of leverage level is around 3x EBITDA in our view. This means that the sample of 25 companies that we covered can take additional leverage of PkR1trillion to fund business expansion.

It is imperative that the country can get out of the debt-financed “get out of jail” card and develop a culture to promote equity investments. Debt as a financing product has asymmetric returns; the lender does not share the downside risk nor does he benefits from any material upside. This leads to perversive incentives. The lender’s only incentive is for the borrower to remain solvent and repay the loan. My former boss, Andrew McNally, has written an excellent book titled, “Debtonator: How debt works for the few and equity can work for all of us” (Click here).

My fear is that I feel that the overzealous anti-corruption drive by NAB (National Accountability Bureau) might be one of the reasons for discouraging businesses to invest. In principle, there is full merit for the need for ensuring transparency and punishing corruption. However, over-drive by legal and regulatory bodies could also choke investments. In Pakistan, the legal system seems to have a tendency to move in extreme swings. The recent judgment against former President Musharraf is an example of such a legal over-drive.

I think the only solution for Pakistan’s debt-driven boom-bust cycle is to tap domestic entrepreneurs and to provide them incentives to invest and expand capacity. The risk is that if the businessmen feel threatened by NAB and are not involved in economic policymaking as that is driven by multi-lateral agencies, then they will have little incentive to invest domestically.

I am, yours truly,

Ali Farid Khwaja

Director

Khadim Ali Shah Bukhari Securities

* This is not research material and there is no investment recommendation in this blog. These are my personal views.