Plunge is higher because of the base effect. Last year, the Eid holidays were in June, so we had a fully functional month of May. This time it was a combination of Eid holidays, industrial, retail & services closure. The trend is obvious now after milder 13% YoY decline in April. Talks on next NFC… Continue reading May Tax Revenues are down 31% YoY & infections rising – Brace for impact!

Category: Economy

CPI Inflation clocks in at 8.2% during May20

Pakistan Bureau of Statistics released the CPI Inflation data for May20. CPI Inflation clocks in at 8.2% Y/Y during May20 compared with a reading of 8.5% recorded during Apr20 and 8.4% during May19. On a cumulative basis, average inflation is 11.0% during 11MFY20 compared with 6.7% recorded during 11MFY19. Ramzan-driven food inflation offsets the decline… Continue reading CPI Inflation clocks in at 8.2% during May20

Economic Calender: June 2020

Current Account Deficit soar to $572 mn in Apr’20

State Bank of Pakistan released the current account data for Pakistan today. Current account deficit soared to $572mn in Apr’20. On yearly basis, current account deficit declined by 51% from $1165mn in Apr’19 to $572mn in Apr’20. For the 10MFY20, current account deficit narrowed by 71% Y/Y from $11,449mn in 10MFY19 to $3,343mn in 10MFY20.… Continue reading Current Account Deficit soar to $572 mn in Apr’20

Economic Impact of COVID-19: Key takeaways from ADB assessment and webinar with Dr. Badri

Asian Development Bank recently published a report updating its assessment of the economic impact of COVID-19. We hosted a webinar with Dr. Badri Gopalakrishnan, the author of the report. Dr. Badri is based in Seattle and is a consulting Economist for the ADB and McKinsey and Company. This note has the summary of the key… Continue reading Economic Impact of COVID-19: Key takeaways from ADB assessment and webinar with Dr. Badri

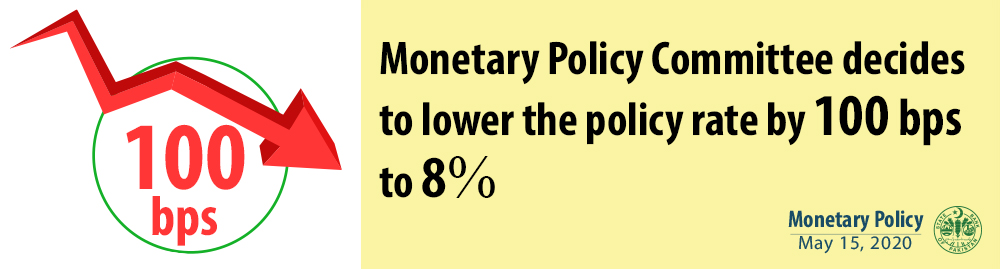

SBP cuts Interest Rates by 100 bps: 13.25% to 8%

From hawks to doves. SBP has demonstrated an inverted U curve with a 525 bps cumulative cuts. More prominent is “economic growth” over “inflation-targeted” Monetary Policy. Textbook monetary policies are out-dated. What’s relevant is the heart-beat of the economy; businesses survival. Ensuring “liquidity” issues don’t turn into “solvency” issues. Loss of jobs is in colossal… Continue reading SBP cuts Interest Rates by 100 bps: 13.25% to 8%

FX Reserve Position-8th May 20

A 50bps cut likely in upcoming MPS

The State Bank of Pakistan (SBP) has scheduled a Monetary Policy Meeting on May 15’20. We anticipate a 50bps cut in interest rates, bringing the policy rate down to 8.50%. As the economic landscape has shifted away from stabilization and moved towards recovery, we believe sustained monetary easing synergizes with the prevalent fiscal stance. Benign… Continue reading A 50bps cut likely in upcoming MPS

Green flag must transition into green economy!

Electric cars, buses & trucks are a reality. So is the plunge in the cost of solar and wind energy. Very soon, South Korea would lead the world into hydrogen economy. This is irreversible technological change. With low oil prices, race to green economy would accelerate. Climate change is a looming threat in the long… Continue reading Green flag must transition into green economy!

US charters into (temporary) deflationary territory

The loss in aggregate demand coupled with plunging energy prices have reduced the inflationary pressures. Corona is a double edge sword: demand destruction and supply chain disruption. Jobs of Central Bank have gotten tougher. Developed markets don’t have easing space in near negative territory. Deflation wreaked havoc in Japan as a classic case study. Triple… Continue reading US charters into (temporary) deflationary territory