Unarguably, the two top global economy experts – Joseph Stiglitz and Nouriel Roubini – predict tough economic outlook. Roubini says post covid growth would be anemic while Stiglitz wants governments to ensure public sector program as long as needed. Stiglitz worries over negative supply shocks, excessive money creation, deglobalisation, government response and eventually, “inflation genie… Continue reading World Economy – Painful post covid growth

Category: Economy

Key Takeaways from Dr. Ali Abbas’s Sovereign Debt Webinar (IMF)

The book was envisaged 10 years ago – the thought, the authors, and the publishers needed to be brought together before the ultimate fruition, which is a testament for academics to envision their end-goals well in advance. The book is written with the intent of communicating the distilled wisdom pertaining to sovereign debt issues to… Continue reading Key Takeaways from Dr. Ali Abbas’s Sovereign Debt Webinar (IMF)

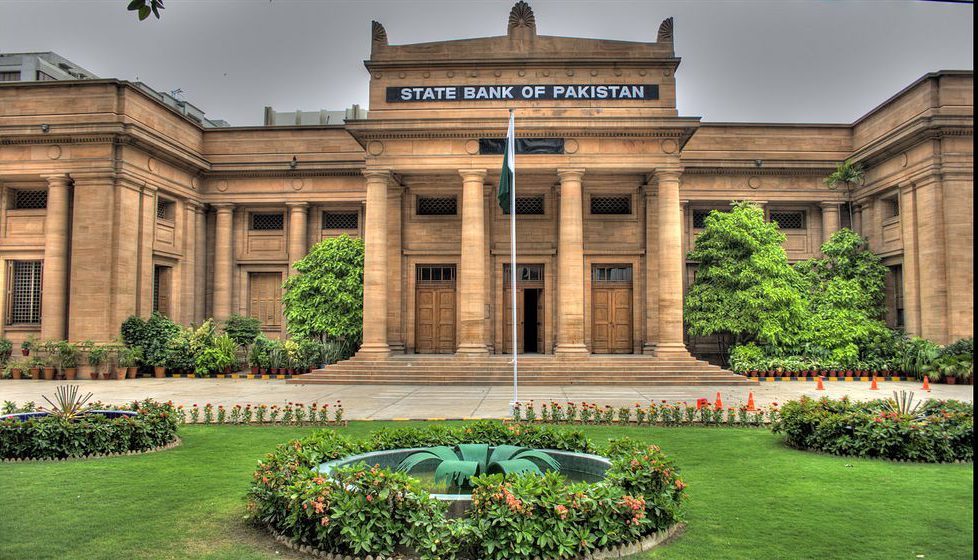

MPS: Monetary Policy Committee cuts interest rate by another 100bps

In its meeting held today, the Monetary Policy Committee (MPC) cut interest rates by an additional 100bps to 7.0%, taking the cumulative reduction to 625bps since the pastthree months. The expedited pace of monetary easing has overshot our original estimates whereby we projected a 50 to 75 bps cut by year end 2020. In light… Continue reading MPS: Monetary Policy Committee cuts interest rate by another 100bps

SBP Reza Baqir “Does More” – Discount Rate cut by 100 bps to 7%

This was on the cards – as posted earlier today – after $1bn FX poured in, Current Account showed surplus & Inflation outlook ranged ~6% for next three years. The growth plunge warranted it amid benign inflationary outlook. Yesterday, the yield curve steepened after PIB auction. The space on shorter side is fixed today with… Continue reading SBP Reza Baqir “Does More” – Discount Rate cut by 100 bps to 7%

Pakistan Bond Auction yields up 30-39 bps : Good-bye further rate cuts?

In the recent bond auction, the yield curve has further steepened. Latest numbers reflect 7.97% (+33bps), 8.44% (+39bps), 8.99% (+30bps) and 9.90% (-7bps) for 3, 5, 10 & 15 years, respectively. Against the target of Rs 150bn, the govt accepted Rs 117bn. Clearly, the participants are realising that lowest yields are behind us. Perhaps, yes.… Continue reading Pakistan Bond Auction yields up 30-39 bps : Good-bye further rate cuts?

Pakistan’s tax payers bear Rs 692bn (~$5bn) loss -government inefficient entities

Wo Afsana Jisay Anjam Par Lana Na Ho Mumkin..Ussay Ik Khoobsoorat Mor De Kar Chor na Acha.. (those matters that can not be concluded should be left on an amicable note) Applies aptly to the saga of loss making PIA, Steel Mill, Railways, SSGC/SNGP and Power companies. Taxpayers lose Rs 2bn everyday. Imagine what we… Continue reading Pakistan’s tax payers bear Rs 692bn (~$5bn) loss -government inefficient entities

Current Account register surplus of $13mn in May’20

State Bank of Pakistan released the current account data for May’20. Current Account registered a surplus of $13mn in May’20. This was the second time in FY20 that Current Account turned into surplus after $72mn in Oct’19. In the 11MFY20 period, Current Account Deficit declined by 74% from $12.5bn in 11MFY19. Current Account Deficit as… Continue reading Current Account register surplus of $13mn in May’20

Pakistan’s top foreign investors quitting – what’s the matter?

ENI has been one of the top on-shore and off-shore Energy player. The Italian company has had a 20 year history in Pakistan and has been at the forefront in creating jobs, exploration and production in energy deficient country. Reasons to pack-up could vary from consolidating global operations after energy transition, poor commercial returns in… Continue reading Pakistan’s top foreign investors quitting – what’s the matter?

Pakistan signs $1.5bn loans after austerity budget – FX reserves to improve

Granted, taking loans is something not to be proud of. But if the glass is half full, the willingness of lenders to give you loans “qualifies” you worthy of repayment, in their point of view. Many countries, Argentina, Venezuela & Ukraine have had economic crises worse than Pakistan. The “tough” budget certifies that Pakistan wants… Continue reading Pakistan signs $1.5bn loans after austerity budget – FX reserves to improve

Pakistan Export Dilemma-A tail of historical incompetence

“The success of the ‘Make in Pakistan’ strategy, crucially depends on its complement ‘Sell to the World’.” World Bank blog presents very sound policy pathways for Pakistan to develop its export base. However, history suggests that Pakistan has been plagued by export incompetence. Industrial inefficiency and government incompetence has doomed Pakistan’s exports. We have failed… Continue reading Pakistan Export Dilemma-A tail of historical incompetence