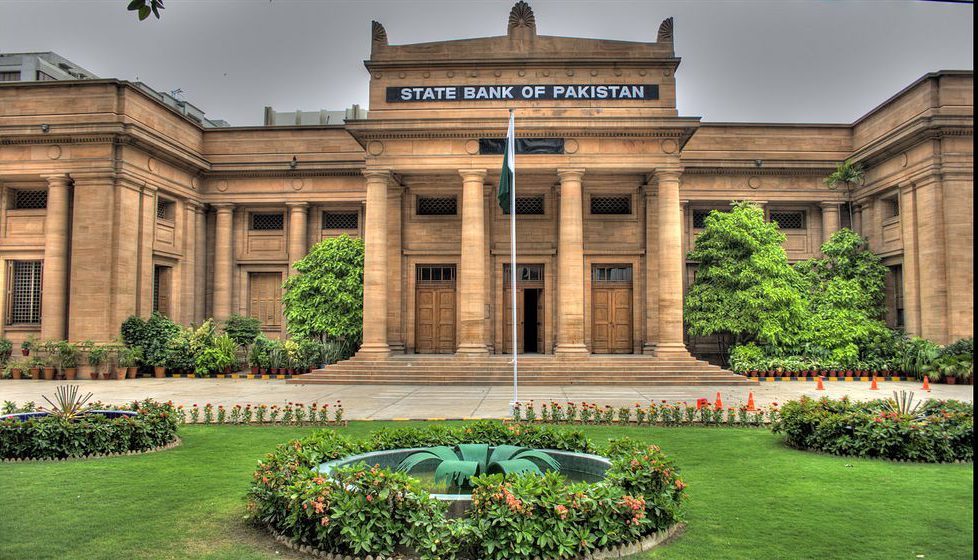

Rates have already been cut 425 bps in two months. Covid-19 shock necessitated relief to the economy. The businesses had to be kept afloat & liquidity needed to be pumped to ensure that businesses don’t die nor are wiped out. Aggregate demand needs to be pulled & jobs protected to avoid cascading domino effect. Host… Continue reading SBP Monetary Policy Committee 15th May : Expect another 50-75bps cut

Author: Anum Qudsia Siddiqui

MSCI Semi-Annual Index Review – May’20

MSCI’s Semi-Annual Index Review is scheduled to take place on 12th May 20. Pakistan Market’s recent downtrend has garnered concerns of potential downgrade to Frontier Status. It is also important to note that Pakistan has been able to hold onto its emerging status despite not meeting the requisites due to the Index Continuity Rule. Pakistan’s… Continue reading MSCI Semi-Annual Index Review – May’20

OMCs to experience another wave of heavy inventory losses

Regulated POL products’ prices were lowered for the second time in the last two months, raising concerns of possible inventory losses for Oil Marketing Companies. Whether these inventory losses would hinder profitability in the upcoming quarter is dependent on the movement in products’ prices in June and July. To recall, the Power Division estimated… Continue reading OMCs to experience another wave of heavy inventory losses

Saudi Arabia diversifies away from Oil Economy: Bold, timely & progressive move!

$27bn worth of Fiscal adjustment is a lot, painful but necessary. The sharpest of all is tripling VAT from 5% to 15%. This would be inflationary but adjusts the economic balance sheet away from Oil revenues. This is a medium term thumbs up! The government didn’t wait for next year for this. Similarly, the monthly… Continue reading Saudi Arabia diversifies away from Oil Economy: Bold, timely & progressive move!

KSE – 100 returns 16% in April – A short-lived V shaped recovery

Well no one is April fooled. After a mind-boggling plunge in the local and global markets, the stock market of Pakistan rose 16% in a single month to catch-up on the lost ground. The rebound was primarily led by government’s policy response to Covid 19. The perils of the virus have accompanied a permanent dent… Continue reading KSE – 100 returns 16% in April – A short-lived V shaped recovery

Pakistan Macro Blog: Whats in a name?

Dear Friends, “Whats in a name? That which we call a rose by any other name would smell as sweet” – Romeo & Juliet Shakespeare was wrong. Names matter. Last week I was talking to a fund manager from Singapore and I mentioned to him that until 2008 Pakistan Stock Exchange (then called Karachi… Continue reading Pakistan Macro Blog: Whats in a name?

Daily News:11th May 2020

Good Morning The weekly inflation during the week that ended May 7, 2020, against April 30, 2020 – week-on-week – witnessed an increase of 0.36 percent for combined income groups, ie, from 126.84 points to 127.30 points, Pakistan Bureau of Statistic (PBS) revealed. Keeping in view the impact of COVID-19 pandemic, Pakistan’s GDP is going… Continue reading Daily News:11th May 2020

Covid-19 and the woes of PIA

Due to Covid-19, economic output is contracting across the world by trillions of dollars, and governments are printing more money while increasing government loans to provide relief to their countrymen. Pakistan too has announced a stimulus package worth $8 billion, but of this amount around $6 billion was already supposed to be provided in the shape of tax… Continue reading Covid-19 and the woes of PIA

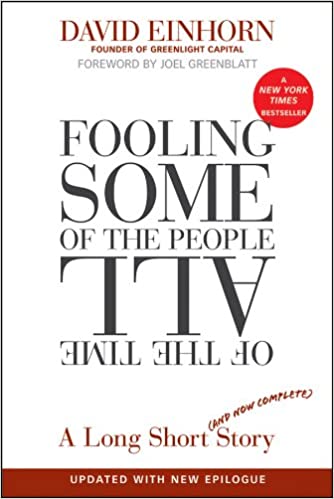

Pakistan Macro Blog: PSX more transparent than London and Frankfurt?

Dear Friends, I have been MIA from this blog. Since the lock down began, I have been writing quite regular (daily) brief notes on the COVID situation and its impact on the economy. Since the 21st of March, we have also hosted 6 webinar with international experts and put our research website live (click here for… Continue reading Pakistan Macro Blog: PSX more transparent than London and Frankfurt?