Dear Clients,

The Hub Power Company (HUBC) stands as our top pick in Pakistan’s IPPs space with a Dec21 TP of PKR 130.3/sh, offering an upside of 59% from its last close of 82.2/sh. The stock has underperformed its benchmark by 23pps with a total stock return (TSR) of 16% FYTD against the KSE-100 index’s return of 31% within the same time frame. The stock’s underperformance can largely be attributed to the energy chain’s cash-flow crunch, which has limited the sector’s pay-out capacities and has increased its overall leverage.

We think a mispricing exists in the stock over expectations of continued prevalence of the cash-flow crunch. With major steps being taken to address the circular debt issue, we believe the foundation is set for the stock to rally considerably.

Renewed focus on alleviating the sector’s cash-flow concerns: Circular debt control has taken center-stage under the IMF-backed economic program. Major developments have materialized with the aim of curbing circular debt proliferation including 1) planned hike of energy tariffs and reduction of power subsidies, 2) timely determination and notification of end-user tariffs, and 3) shifting of the national energy mix towards cheaper resources.

Clearance of overdue receivables approved: The Economic Coordination Committee (ECC) recently approved clearance of overdue receivables of IPPs, including HUBC’s base plant. The company has received 40% of its overdue, amounting to PKR 23.2 bn (PKR 18/sh), of which PKR 7.7bn (one-third) was in cash while the remainder was in liquid PIBs and Sukuks. The remaining 60% overdues are scheduled be received under a similar structure after 6 months. This payment will potentially allow HUBC to reduce its overall debt balance and enhance its payout capacity.

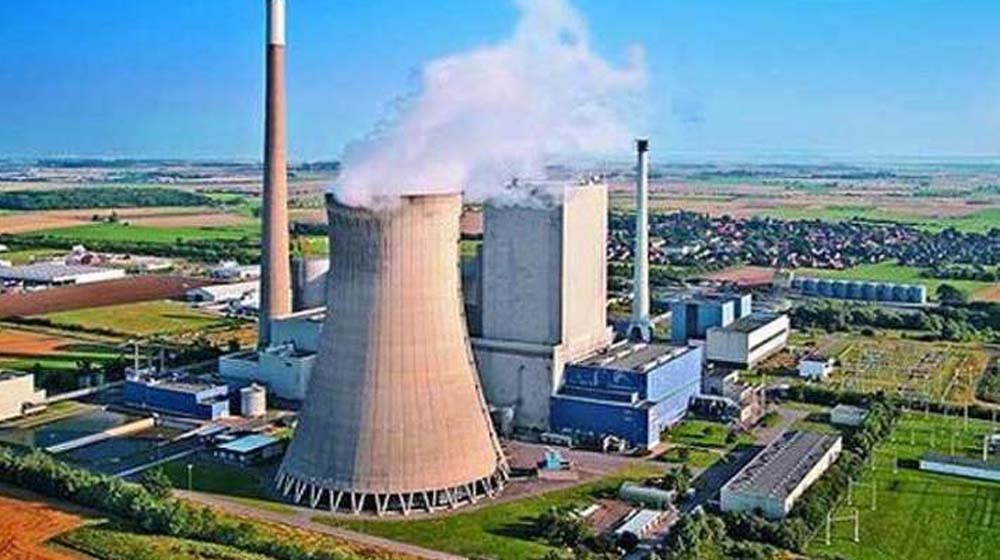

The growth story still intact: HUBC is the only IPP promising a long term growth story. CPEC’s coal-based energy projects are estimated to yield HUBC a 5yr earnings CAGR of 27% by FY24. This growth is underpinned by guaranteed USD & inflation-hedged annual ROE of 27.2%-30.6% over a 30yr period.

Negotiations of a contract buyout adding further clarity to cash-flows: HUBC’s management has offered the GoP to buy out the Power Purchase Agreement (PPA) contract of its base plant for PKR 65bn (PKR 50.1/sh) in a bid to forgo future capacity payments for the remainder of the contract, which is set to expire in FY27. We project the base plant’s capacity payments to sum to PKR 179bn, with an estimated present value of PKR 97bn (adjusting for expenses). While the transaction will be value-attritive, we believe HUBC offered a discounted buyout price for the certainty of cash-flows.

Further diversification of revenues streams planned through upstream investments: HUBC has informed investors of acquiring the operations of ENI in a JV with ENI’s employees (50:50). ENI is an upstream oil exploration venture, which presently has stakes in 7 operating fields with its primary stake in Bhit (40%) and Badhra (40%). Based on the average output levels of 2QFY21, ENI’s oil production stood at 83bopd and its gas production stood at 77mmcfd. This potential investment marks HUBC’s initial venture into the upstream energy chain.

Price Target of PKR 130.3/share, offering 59% upside: With significant value derived from its growth projects, HUBC offers an upside 59% over its last close of PKR 82.2/sh. The stock is trading at an undemanding PE multiple of 3.0x and potentially offers a dividend yield of 15% (FY22), significantly higher than the market’s average yield of 5%.

Regards,

KASB Research