In 2021, Rs 550bn out of Rs 1,000bn capacity charges stem from government entities: CPEC Rs 180bn, old-WAPDA Rs 110bn, new-WAPDA Rs 170bn & LNG projects Rs 100bn. By 2025, these would be Rs 850bn out of a colossal Rs 1,700bn as the nuclear power’s 6.6c charges kick in. These are shockingly high numbers in… Continue reading Power Sector : Government revisits agreed profitability terms

Category: Economy

April’s Tax Collections fall 17% YoY. Surely, not the worst!

April was a month of a universal lock-down. The essential services – with minimum staff – and strategically important local and export industries were allowed to operate. That too was a bare minimum. Some – including myself – presumed a Tax fall of 40-50% YoY. A 17%, therefore, doesn’t reflect a total collapse, thankfully. The… Continue reading April’s Tax Collections fall 17% YoY. Surely, not the worst!

Hafeez Shaikh & Reza Baqir’s CPR to the economy!

Under the pre-Covid IMF rehab, it was a non-flexible approach to monetary & fiscal tightening. The tables have turned. For the hawks as well. The Hafeez-Reza duo have re-written their prescriptions. Reza Baqir loosened the discount rate by 425 bps from a contracting 13.25% to an accommodating 9%. Host of other measures are announced to… Continue reading Hafeez Shaikh & Reza Baqir’s CPR to the economy!

Inflation estimated to register at 8.7% during Apr’20

After a 9M period of double-digit inflation, CPI is expected to enter single digits and register at 8.7% during Apr’20 against 10.24% recorded during Mar’20 and is expected to average at 11.3% during 10M FY20. On a monthly basis, inflation is estimated to recede by 0.67% primarily due to subdued food inflation and the transport… Continue reading Inflation estimated to register at 8.7% during Apr’20

Why Pakistan cannot afford declining remittances?

Fact check: Pakistan’s remittance inflows in 9MFY20 were enough to easily cover its Balance of Trade deficit. This definitely suggest why Pakistan cannot endure decline in remittances. Inbound remittances have always provided cushion not only to our foreign exchange reserves but also to our current account deficit. Fact of the matter is that as a… Continue reading Why Pakistan cannot afford declining remittances?

How will falling oil prices impact Pakistan?

The command that oil holds over the global economy was evident in 1973, when oil producing Arab nations restricted oil sales during the Yom Kippur war, thus resulting in oil prices quadrupling. Thus, the recent oil market crash leading to a 70% decline in oil prices from $70 per barrel to $20 per barrel is a cause for concern… Continue reading How will falling oil prices impact Pakistan?

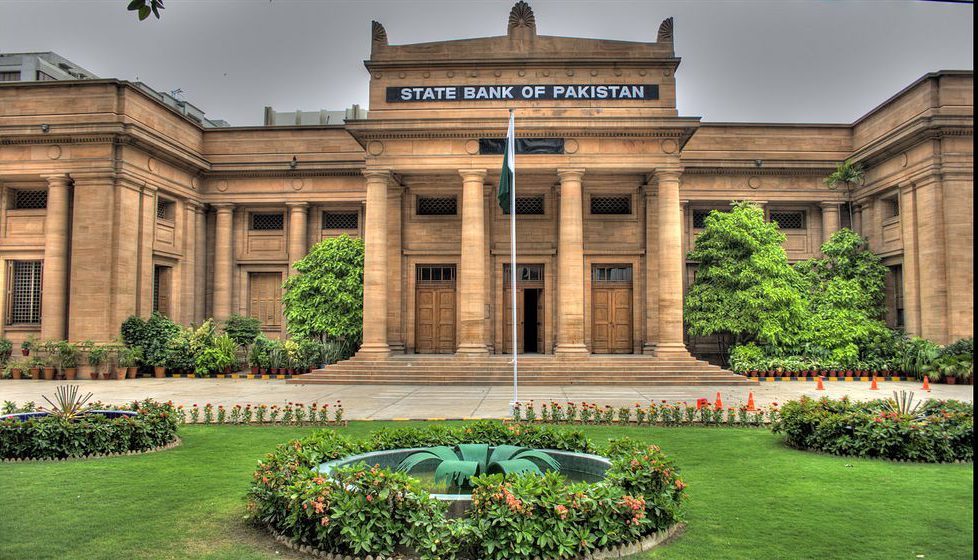

Current Account Deficit shrinks by 99% Y/Y to $6mn in Mar’20

State Bank of Pakistan released the current account data for the month of March today. Current account deficit came out to be $6 million in March’20, a decline of 99% Y/Y and 97% M/M. Major contribution in this decline came from the dip in Balance of Trade deficit. BOT deficit contracted by 29% Y/Y from… Continue reading Current Account Deficit shrinks by 99% Y/Y to $6mn in Mar’20

Macro Update:Is the economy shrinking by -14% in March Quarter?

▪In the Monetary Policy Statement published today, the State Bank of Pakistan has followed the IMF and reduced FY20 GDP growth forecast to -1.5% from its earlier target of 2.5% growth. If we assume that the GDP had grown inline with the government’s original target of 2.5% until start of March, before the lockdown began… Continue reading Macro Update:Is the economy shrinking by -14% in March Quarter?

MPS: Monetary Policy Committee cuts interest rate by another 200bps

In its emergency meeting held today, the Monetary Policy Committee (MPC) cut interest rates by an additional 200bps to 9.0%, taking the cumulative reduction to 425bps since the past month. The expedited pace of monetary easing has overshot our original estimates whereby we projected a 100bps cut by May20. In light of the anticipated contraction… Continue reading MPS: Monetary Policy Committee cuts interest rate by another 200bps

Can Pakistan’s economy endure the ramifications of COVID-19?

As of now, it is abundantly clear that coronavirus has upended textbook economics, global stock markets, currency rates, and unearthed massive socio-economic inequality. Unfortunately, according to the United Nations (UN), Pakistan could be one of the countries hardest hit by the economic fallout which this pandemic is ushering in. The report by the UN Conference on Trade… Continue reading Can Pakistan’s economy endure the ramifications of COVID-19?