Understanding and managing risk is fundamental to building a resilient investment portfolio. The article will help you navigate through the complexities with confidence and alongside, KTrade Securities is there to be your guide!

But first, let’s delve into some of the key risks involved in investing so that you know which factors to keep track of:

Types of Risk In Investing

1. Market: This refers to the potential for losses due to overall market downturns, impacting even the most carefully selected investments.

2. Company-Specific: Despite a thriving market, factors such as management changes, legal issues, or product failures can lead to losses in individual stocks. Learn more about how to protect your investments by determining the real value of your potential stock purchase. Read our blog: How to Properly Value A Company.

3. Volatility: Short-term price fluctuations can be challenging, especially for investors seeking quick profits.

4. Liquidity: Some stocks may be difficult to sell quickly, particularly during urgent situations requiring immediate access to funds.

5. Inflation: The erosion of purchasing power over time can diminish returns, even in a booming market.

6. Interest Rate: Rising interest rates can decrease the attractiveness of certain investments to investors.

7. Currency: Investing in foreign currency-denominated stocks exposes investments to fluctuations in exchange rates.

8. Behavioral: Emotions and biases can influence investment decisions, leading to suboptimal outcomes.

Want to learn how to trade? Open your account with KTrade today: https://bit.ly/48jLuJz.

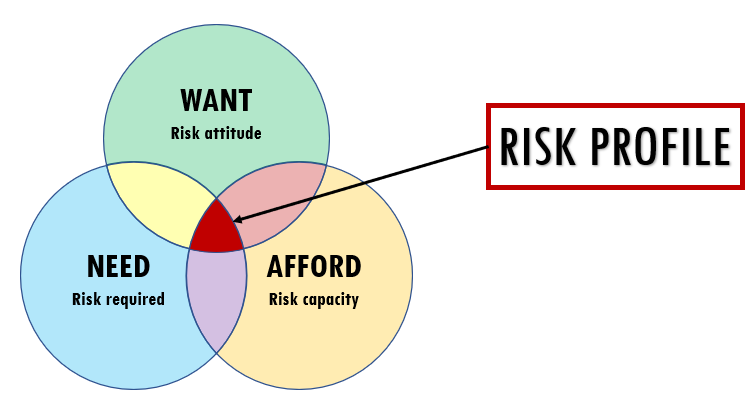

How To Assess Your Risk Profile

1. Financial Goals: Determine your financial objectives to gauge the level of volatility you can afford to take. Those aiming for higher returns may need to accept higher-risk investments.

2. Investment Horizon: Consider the length of time you plan to hold your investments. Longer horizons typically allow for more aggressive strategies, while shorter horizons call for a more conservative approach.

3. Risk Tolerance: Evaluate your willingness to take on uncertainty in pursuit of higher returns. Some investors are comfortable with greater volatility, while others prefer more conservative options.

4. Financial Situation: Your current financial standing plays a crucial role in determining your risk profile. Those with stable finances may be more inclined to take on higher-risk investments.

5. Experience and Knowledge: Assess your experience and knowledge of investing. Seasoned investors may feel more comfortable with riskier assets, whereas newcomers may opt for safer choices initially.

By considering these factors, you can develop an asset allocation strategy tailored to your profile. Remember, diversification is key to building a resilient portfolio. Sign up with KTrade Securities to ensure you make smart investment decisions, that mitigate risk and enhance long-term returns.

At KTrade Securities, we understand the importance of aligning your investments with your risk profile. Our comprehensive range of investment options and personalized advice can help you navigate the complex world of investing with confidence. Check out some of our expert guidance here, on our YouTube Channel.

In conclusion, assessing your profile is a critical step toward making informed investment decisions. By understanding your tolerance for uncertainty and aligning your investments accordingly, you can embark on a journey toward financial success. Start assessing your profile today with KTrade Securities as your trusted partner in achieving your investment goals.

KTrade x Multan Sultans for HBL PSL 9!

KTrade is the official investment partner of Multan Sultans.

Cricket is the ultimate celebration of struggle, persistence, determination, teamwork, and championship. For us, Multan Sultans represent the underdogs who are in overdrive. Champions who hit beyond their weight through their heart.

KTrade is the most popular stock trading app in Pakistan which has over 1 million downloads. For over 70 years, KASB Group has been a leader in helping Pakistani people invest in stocks, and mutual funds and for bringing in investment in Pakistan.